Theme: Innovations and Opportunities: The Evolving Landscape of Finance

Finance 2023

Conference Series welcomes you to attend the Global summit on Finance, Banking and Economics on September 14-15, 2023 in Paris, France. It focuses on the theme: "Innovations and Opportunities: The Evolving Landscape of Finance". Therefore this conference provides a superb chance to debate the most recent developments within the field.

Conference Series organizes over 3000+ Global Events with over 600+ Conferences, 1200+ Symposiums and 1200+ Workshops on Finance, Banking, Engineering, Science, Technology and Business, Medical.

It covers a wide range of important sessions in Finance Conference 2023 is a webinar which includes thought inspiring Keynote Presentations, Plenary Talks, Symposiums, Special Sessions and Career Development Programs.

This conference will cover the professionals gathering from Banking Sectors, Business, Wealth management, Consumer Banking, Commercial Banking. Also executives and eminent research personalities from the departments of Accounting, Finance, Banking sectors etc.Shall be an integral part of this conference.

TRACK 01: Finance, Accounting, and Company Governance

Finance, Accounting, and Company Governance track emphasizes investment and financing choices financial and corporate reporting and risk management in multinational firms. Firms utilize various governance approaches and allocate decision-making to maximize organizational value while following financial reporting requirements of various nations. Corporate governance encompasses varying levels of internal and external oversight – board structures, compensation practices, ownership patterns, shareholder activism efforts, and disclosure choices across firms and national markets

We invite contributions on international finance and accounting, sustainable finance, Management and corporate governance practices in an international context. We welcome novel research on the determinants of governance practices such as legal, financial, and political institutions, and their influences on performance outcomes, accounting standards, financial reporting quality, tax planning practices, financial risk management practices, ESG practices, climate risk management, bank lending, capital market development, venture capital development, and mergers and acquisitions

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 02: Business Resilience below international Disruptions

International Business is littered with varied aspects of world disruptions like pandemic, war, money crisis and temperature change. Resilience might not be identical for all parties involved and reactions to resilience might cause more disruptions to the established orders of geo-economics and geo-politics. This track welcomes submissions associated with resilience of companies, managers and policy manufacturers to deal with varied aspects of world disruptions. Disruptions vary from the geo-political tensions, shrinking international trade and sales changes in shopper behavior, international price chain disruption, disruption in international innovation and data sourcing, disruption in human resource quality and employment and money disruption among others. This track welcomes submissions that ask for to advance our data regarding the complexness of resilience that's required to retort to all or any varieties of international disruptions

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 03: International Entrepreneurship

The post-pandemic world continues to be characterized by heightened geo-political tensions and dire economic, social and environmental challenges. It is the role of international entrepreneurs and entrepreneurial firms to be alert to discover and pursue opportunities in this context, opportunities that arise as a result of cross-border differences in resource and institutional endowments, capabilities and technologies. This track seeks contributions that examine internationalization processes primarily as an entrepreneurial process of discovering, assessing and exploiting international business opportunities from various theoretical lenses using a variety of methodological approaches and datasets.

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 04: Finance and Economy for Society

The growing pace of financialisation of the past four decades has led to the acceleration of commodification, stirring the debate in the academia on the purpose and mission of finance for the society and economy. The unfettered financialisation and commodification of the global economy has been at the origin of financial crises and the degradation of the socio-ecological ecosystem. Building on the conference theme Transforming Business for Good the track invites conceptual and empirical contributions that highlight the transformative power of Finance for Good and its development and use as a vehicle to enhance social impact and transformation.

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 05: Philosophy of Business Ethics

The topic aims to collect any kind of study that successfully applies and adopt philosophical paradigms to explain, interpret and impact ethical behaviours in management and business. We are looking for novel or established approaches to create synergies between philosophical studies and managerial disciplines. Both in terms of theoretical paradigms and methods of analysis employed and we are open to a broad range of elements: Virtue Ethics, Consequential and Non-Consequential Ethics, Marxist and Gramsician Ethics, Continental Philosophy, Social and Political Philosophy, CSR, Sustainability and Business Ethics, Corporate Misconduct and Corporate Political Activity, Ethics of Care, Technology, Artificial Intelligence and Business Ethics

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 06: Start-up Entrepreneurship

Start-up is characterized as these days evolved enterprise to fulfil the marketplace needs. It mainly spins across the imaginative thoughts, contemplations, locating new items, new administrations and so forth. The powerful voyage of the organization at the essential concept and running via way of and massive likewise assumes a key process with inside the success of the start-up. Approving the results to attract in more property by way of ventures, Revenue stocks and so forth expands the volume of the organization.

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 07: Wealth Business Management

Wealth Management is an investment advisory service that combines other financial services to address the needs of affluent clients. A wealth management advisor is a high-level professional who manages an affluent client's wealth holistically typically for one set fee

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 08: Commercial Banking

Commercial Banking focuses on products and services that are specifically designed for businesses, such as deposit accounts, lines of credit, merchant services, payment processing, commercial loans, global trade services, treasury services, and other business-oriented offerings

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 09: Entrepreneurial finance and venture capital

Entrepreneurial companies face main issues like a high-risk investment. In return to that risk, they will also face high returns also. The two main sources for the accumulation of the capital are the Banks and the Venture Capitalist. Banks will monitor less effectively and they face the capitals demands from their own investors. Venture capitalist monitor high effectively and face a high cost of capitals. But the disadvantage of a venture capitalist is they charge a large number of returns of at least 30-40% per year whereas this is very less in banks. The capital amounts provided by the banks or the venture capitalist changes based on the type of ventures.

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

TRACK 10: Market microstructure and algorithmic trading

Trading is central to the investment process. This course will present foundational concepts and current developments relating to trading in financial markets including algorithmic and high frequency strategies, optimal order execution and quality analysis, the dynamics of limit order markets the regulatory and institutional landscape, programming and IT infra-structure and the economics of market microstructure. The course will specifically consider trading in fixed income and futures markets as well as in equity markets.

Finance Conferences | Banking Conferences | Business Conferences | Commercial Banking | Wealth Management | Paris Conferences | Paris Finance Conferences |

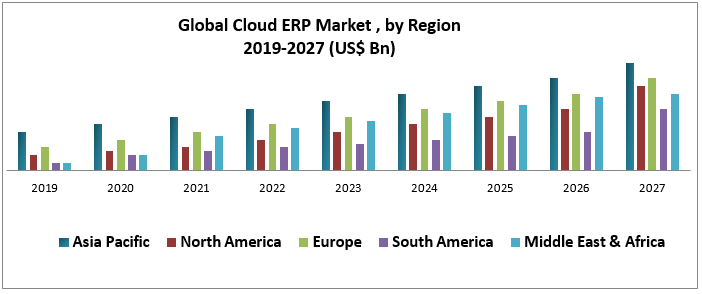

The Financial Sector undergoing rapid expansion, both in terms of strong growth of existing Financial Services firms and new entities entering the market. The sector comprises commercial banks, insurance companies, non-banking financial companies, co-operatives, pension funds, mutual funds and other smaller financial entities. The banking regulator has allowed new entities such as payment banks to be created recently there by adding to the type of entities operating in the sector. However, the financial sector in Paris is predominantly a Banking Sector with commercial banks accounting for more than 64% of the total assets held by the financial system The core parts of the market analysis are:-

- The Financial Services Industry has seen major achievements in the recent past:

- In May 2022, Unified Payments Interface (UPI) recorded 5.95 billion transactions worth Rs. 1,041,520.07 (US$ 132.86 billion).

- In May 2022, the number of transactions through immediate payment service (IMPS) reached 471.62 million (by volume) and amounted to Rs. 4.44 trillion (US$ 55.72 billion).

- In 2021, Prosus acquired Paris payments gaint billdesk for US$ 4.7 billion.

- In September 2021, eight Paris banks announced that they are rolling out—or about to roll out—a system called ‘Account Aggregator’ to enable consumers to consolidate all their financial data in one place.

- In September 2021, Piramal Group concluded a payment of Rs. 34,250 crore (US$ 4.7 billion) to acquire Dewan Housing Finance Corporation (DHFL).

Financial Services industry has experienced huge growth in the past few years. This momentum is expected to continue. In London the private wealth management Industry shows huge potential. Paris is expected to have 6.11 lakh HNWIs by 2025. This will indeed lead Paris to be the fourth largest private wealth market globally by 2028. Paris insurance market is also expected to reach US$ 250 billion by 2025. This will further offer london has an opportunity of US$ 78 billion of additional life insurance premiums from 2020-30.

Today one of the most vibrant global economies on the back of robust banking and insurance sectors. The relaxation of foreign investment rules has received a positive response from the insurance sector, with many companies announcing plans to increase their stakes in joint ventures with Paris companies. over the coming quarters there could be a series of joint venture deals between global insurance giants and local players.

Conference Highlights

- Finance, Accounting and Company Governance

- Business Resilience below international Disruptions

- International Entrepreneurship

- Finance and Economy for Society

- Philosophy of Business Ethics

- Start-up Entrepreneurship

- Wealth Business Management

- Commercial Banking

- Entrepreneurial finance and venture capital

- Market microstructure and algorithmic trading

To share your views and research, please click here to register for the Conference.

To Collaborate Scientific Professionals around the World

| Conference Date | September 14-15, 2023 | ||

| Sponsors & Exhibitors |

|

||

| Speaker Opportunity Closed | |||

| Poster Opportunity Closed | Click Here to View | ||

Useful Links

Special Issues

All accepted abstracts will be published in respective Our International Journals.

Abstracts will be provided with Digital Object Identifier by